UNSUNG HEROES: Checking Excessive Corporate PILOTs

Local & National News | March 08, 2024

Though Commissioners prompted the report, it has not been scheduled for a formal hearing before the County Commission.

Written By: Joe B. Kent

Currently, two unsung public heroes exist in Shelby County. The heroes are Assessor Melvin Burgess and Assessor CAO Javier Bailey. With ARPA funding expiring, a plethora of public needs and the potential for tax increases, these two set out to question the economic viability of corporate real estate payment in-lieu-of taxes (PILOT) programming.

To that extent, Assessor Melvin Burgess and Assessor CAO Javier Bailey released a study, to the County Commission on December 19, 2023 entitled “2023 Special Report: Economic Impact From Use of PILOT Incentives”. The report was prompted by questions raised by County Commissioners Brooks, Avant and Thornton. And, while not mentioned in the report, Commissioner Michael Whaley has also raised questions.

But surprisingly, even though Commissioners prompted the report, it has not been scheduled for a formal hearing before the County Commission. This is unfortunate, as the topic of PILOTs is often complicated and likely to require multiple hearings to accomplish needed PILOT reform, even though a robust environment exists in Shelby County for the total elimination of PILOTs. This is because, per the Greater Memphis Chamber, Memphis has been identified as the most affordable city in the nation by Business Facilities Magazine. The former eliminates the need for the public’s involvement in business operating cost reduction, as produced through PILOTs.

The Assessor’s report economically benchmarks Shelby County’s use of PILOTs, against the macroeconomic state legislative intent of PILOT incentives in support of creating jobs and providing affordable housing. This is the first known formal study published by a local government in Shelby County, on the economic viability of corporate tax incentives.

A PILOT stands for a contractual agreed upon payment in-lieu of full [commercial] property taxes (PILOT). The portion less the PILOT payment is known as an “abatement”, or the amount of commercial property taxes forgiven from paying full commercial property taxes. The Assessor Report states that between 2019-22 that County tax collections were reduced, through commercial property tax abatements by $153M or an average of $38M per year. From the County totals, it is estimated that tax collections, due to PILOT incentives, were reduced between 2019-22 by $260M or an average of $65M per year, across all local governments throughout Shelby County.

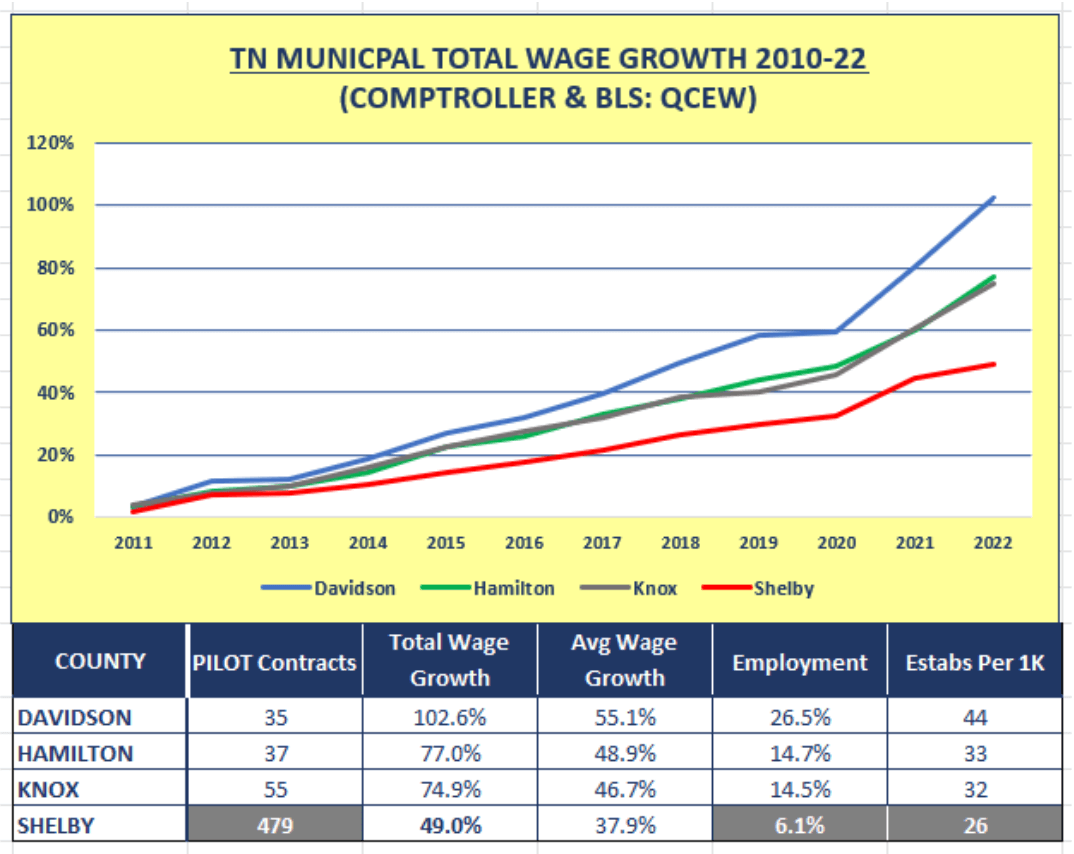

The Report also states “While Shelby County maintains over 500 PILOT incentivized properties over the past 4 years, Davidson County boasts of less than 40 such projects. However, Davidson County’s economy shows substantial growth. The same data trends are indicated in Hamilton, Knox, Williamson, and Rutherford Counties. These counties sparingly utilize PILOT incentives and have suppressed unemployment and show strong economic revenue bases, as opposed to a stagnant economy and slow workforce development in Shelby County.”

And then the report concludes with “After considering the fiscal investment in PILOT incentives and the so-called return on that investment in the form of general economic growth, the current method and manner of issuing PILOT incentives to developers and corporations has proven to be fiscally off-balance and not economically feasible in terms of public policy.”

Convergent Findings

The Assessor Report findings can be further supported by convergent data findings from additional data sources. The above table/chart source data comes from the 2022 Tennessee Comptroller PILOT report and the Bureau of Labor Statistics (BLS) Quarterly Census of Employment Wages (QCEW) program.

The table/chart combination documents elements of total wage growth since the creation of Shelby County’s Economic Development Growth Engine (EDGE) in 2011. EDGE approves more PILOTs than any other local industrial development board (IDB), with a non-exclusive but primary macroeconomic focus on job creation.

At the same time EDGE has only approved a portion of the 479 Shelby County PILOTs accounted for in the above table, as there are eight other IDBs in Shelby County with PILOT approval authority. One can easily see from the table/chart above, the excessive number of PILOTs granted in Shelby County vs other TN municipal counties, coupled with Shelby County’s much weaker total wage, average wage and employment growth and low business establishment count per 1,000 population.

Conclusion & The Facts

With excessive amounts of public money going out the door, compounded public needs and threats of property tax increases, robust ongoing discussions of PILOT reform are needed now in public chambers. This is because tax increases without meaningful PILOT reform blows up income inequality, due to corporations and developers only paying 25% of any property tax increase and taxpayers paying 100%. Discussions on this matter are well past due and should start now.

Check the Facts

- Shelby County Assessor. 2023 Special Report: Economic Impact From Use of PILOT Incentives. December 19, 2023. https://1drv.ms/b/s!AiNXRWm6KZQigp1D2qWfgCxmvkcW_w?e=lIDbGP

- TN. Comptroller. 2022 PILOT Report. https://comptroller.tn.gov/content/dam/cot/sboe/documents/tax-incentive-programs/2022PILOTReport.pdf

- Bureau Labor and Statistics. Quarterly Census of Employment Wages (QCEW). https://www.bls.gov/cew/

#grabmyCARD

JustMy is about supporting LOCALS, check out these LOCAL area businesses and organizations! Everything you want to know about them is here! Like and Share TODAY! If you are a local business and would like a free listing with us, create your Digital Business Card today and we will share it with the community!